Fill out your information, and we'll do the calculations for you

Blog Details

Gross Monthly Income: What It Is and How to Calculate It From Any Pay Schedule

If an application asks for gross monthly income, it is asking for the money you earn before taxes, benefits, and other payroll deductions are withheld. ADP explains gross pay as earnings before withholdings, while net pay is what remains after deductions.

This guide shows the fastest way to calculate your gross monthly income, using the same pay-period math payroll providers use.

Quick Answer Box

Gross monthly income = your total monthly earnings before deductions.

To calculate it, convert your pay schedule into a monthly number using the formulas below.

Step 1: Identify Your Pay Schedule

Most people are paid on one of these schedules:

|

Pay Schedule |

Paychecks per Year |

Best Formula |

|

Monthly |

12 |

monthly gross = paycheck amount |

|

Semi-monthly (twice per month) |

24 |

monthly gross = paycheck × 2 |

|

Biweekly (every 2 weeks) |

usually 26 |

monthly gross = paycheck × 26 ÷ 12 |

|

Weekly |

52 |

monthly gross = paycheck × 52 ÷ 12 |

ADP notes that biweekly pay commonly results in 26 paychecks per year, and some years can have 27 pay periods.

ADP also explains the difference between biweekly (26) and semi-monthly (24) schedules. (Source:- adp.ca)

Step 2: Use the Right Formula

If you are paid salary (annual pay)

Formula: annual salary ÷ 12

Example:

$72,000 ÷ 12 = $6,000 gross per month

Indeed uses the same “annual ÷ 12” approach for monthly gross calculations.

If you are paid hourly

Formula: hourly rate × hours per week × 52 ÷ 12

Example:

$22/hour × 40 hours/week = $880/week

$880 × 52 = $45,760/year

$45,760 ÷ 12 = $3,813.33 gross per month

This weekly-to-annual-to-monthly method matches how common salary converters explain monthly conversions.

If you are paid weekly

Formula: weekly gross × 52 ÷ 12

Example:

$950/week × 52 = $49,400/year

$49,400 ÷ 12 = $4,116.67 gross per month

If you are paid biweekly (every 2 weeks)

Biweekly is usually 26 paychecks per year.

Formula: biweekly gross × 26 ÷ 12

Example:

$2,150 × 26 = $55,900/year

$55,900 ÷ 12 = $4,658.33 gross per month

Tip: In some years there may be 27 pay periods, so your annual total can be slightly higher than expected.

If you are paid semi-monthly (twice a month)

Semi-monthly is 24 paychecks per year.

Formula: semi-monthly gross × 2

Example:

$2,400 × 2 = $4,800 gross per month

Step 3: Add Other Income Only If the Form Requires It

Many applications want “all income,” while others want only employment income. If the form does not specify, use a safe approach:

- Include: wages/salary, overtime, commissions, bonuses that show up on pay stubs

- Be careful with: irregular side income (use an average)

Indeed’s guidance on gross monthly income notes that gross monthly income can include multiple income sources.

How to Handle Variable Pay (Overtime, Commission, Tips)

If your income changes week to week, do not use your highest paycheck.

Use an average:

- Collect the last 8–12 weeks of pay stubs (or 3 months).

- Add the gross pay amounts.

- Divide by the number of months covered.

This gives a realistic monthly number that matches how many landlords and lenders interpret “monthly income.”

The Most Common Mistake: Biweekly vs Semi-monthly

These sound similar, but they are not the same:

- Biweekly: every two weeks (usually 26 paychecks per year)

- Semi-monthly: twice per month (always 24 paychecks per year)

If you mix them up, your monthly income can be off by hundreds of dollars.

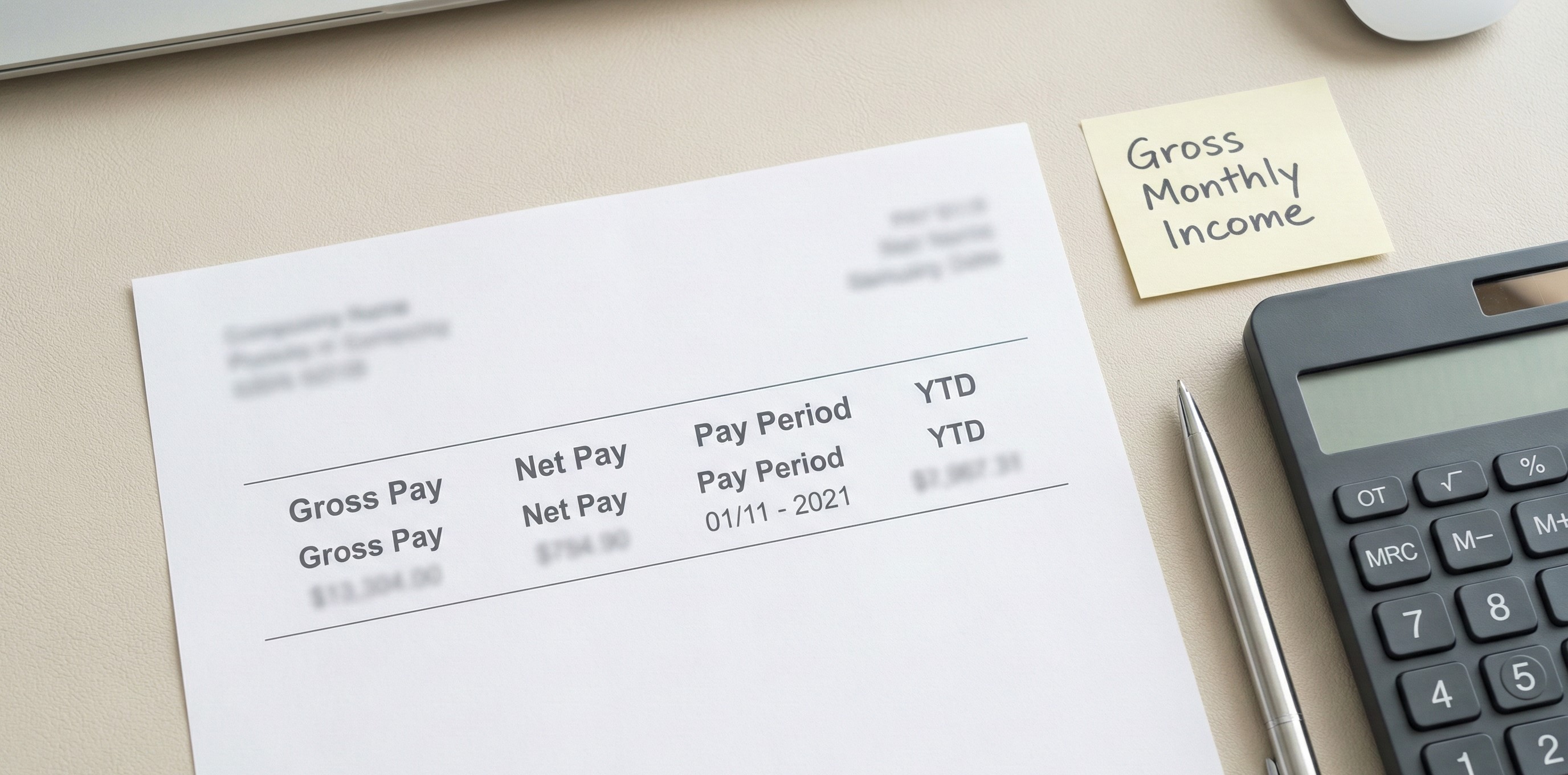

Where to Find Gross Pay on Your Pay Stub

Most pay stubs show:

- Gross pay (this pay period)

- Year-to-date gross

- Taxes and deductions

- Net pay (take-home)

Gross pay is the number you want for monthly income conversions. ADP’s explanation of gross vs net pay aligns with this use.

Mini “Do-It-Yourself Calculator” (Fast Method)

Pick the line that matches your pay schedule:

- Monthly: gross paycheck = gross monthly

- Semi-monthly: gross paycheck × 2

- Biweekly: gross paycheck × 26 ÷ 12

- Weekly: gross paycheck × 52 ÷ 12

- Hourly: hourly × weekly hours × 52 ÷ 12

If you want a quick cross-check, salary converters like Calculator.net provide the same conversions between hourly, biweekly, monthly, and annual amounts.

FAQ

What is gross monthly income?

It is your total monthly earnings before taxes and deductions are withheld.

How do I calculate gross monthly income from biweekly pay?

Multiply your biweekly gross by 26, then divide by 12.

How do I calculate gross monthly income from semi-monthly pay?

Multiply your semi-monthly gross by 2 (because there are 24 paychecks per year).

Need a Pay Stub to Confirm Your Gross Income?

If you are filling out a rental application, loan form, or benefits paperwork, it helps to have a clean pay stub that clearly shows your gross pay, pay period, and year-to-date totals.

You can generate a professional pay stub in minutes using ePayStubs here: Generate paystub

Last updated: January 10, 2026