Fill out your information, and we'll do the calculations for you

Blog Details

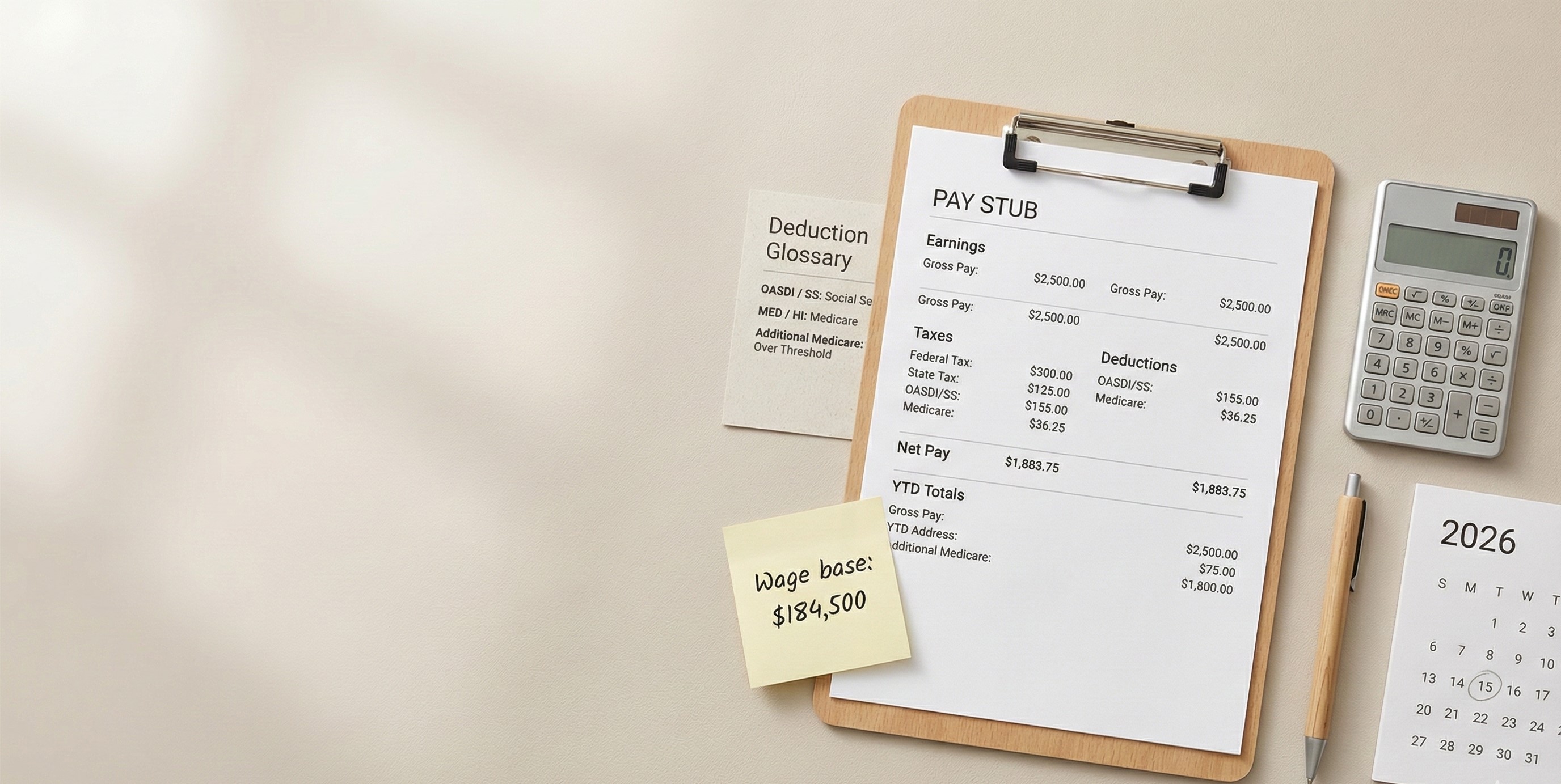

2026 Pay Stub Deductions Explained: FICA, Medicare, and the $184,500 Wage Base

Most people only notice payroll taxes when something looks different on a paycheck. One week your pay stub shows Social Security (OASDI) coming out as usual. A few months later it drops to $0. Or a new line appears that says Additional Medicare and you think something broke.

In 2026, there is a very normal reason for a lot of these changes: the Social Security wage base is $184,500. Once your year-to-date wages hit that cap, Social Security withholding can stop for the rest of the year. Medicare does not work that way. Medicare keeps going.

This guide explains the 2026 pay stub deduction lines in plain language, with quick tables and real-life “why did this change?” scenarios.

Note: This is general information, not tax advice.

Quick Answer (2026 pay stub deductions)

- Social Security (often shown as OASDI, SS, or FICA-SS) comes out at 6.2% from your wages until your year-to-date Social Security wages reach $184,500 in 2026. After that, the Social Security line can stop for the rest of the year.

- Medicare (often MED, HI, or FICA-MED) comes out at 1.45% on covered wages and does not stop because there is no wage cap for Medicare.

- Additional Medicare Tax (0.9%) can start once your wages for the year go over $200,000. Employers start withholding at $200,000 even though the final tax threshold depends on filing status.

2026 FICA and Medicare cheat sheet

|

Pay stub tax line |

What it is |

2026 employee rate |

Stops at a cap? |

What you might see happen |

|

Social Security (OASDI / SS / FICA-SS) |

Social Security payroll tax |

6.2% |

Yes, stops after $184,500 wages |

Line goes to $0 later in the year |

|

Medicare (MED / HI / FICA-MED) |

Medicare payroll tax |

1.45% |

No cap |

Line keeps showing every paycheck |

|

Additional Medicare |

Extra Medicare tax |

0.9% on wages over threshold |

No cap |

New line may appear after $200,000 wages |

The pay stub labels people actually see

Pay stubs rarely spell everything out. These are common labels:

|

Label on pay stub |

What it usually means |

|

OASDI |

Social Security tax |

|

SS / Soc Sec |

Social Security tax |

|

FICA-SS |

Social Security part of FICA |

|

MED |

Medicare tax |

|

HI |

Medicare tax (Hospital Insurance) |

|

FICA-MED |

Medicare part of FICA |

|

Addl MED / Additional Medicare |

Extra 0.9% Medicare withholding (high wages) |

If your stub uses different labels, the idea stays the same: Social Security has a cap. Medicare does not.

1) What “FICA” means on a pay stub

FICA is shorthand for two payroll taxes taken out of many W-2 paychecks:

- Social Security (often shown as OASDI / SS)

- Medicare (often shown as MED / HI)

Some pay stubs show “FICA” as a single heading and then list Social Security and Medicare under it. Other stubs list them as separate lines.

2) Social Security (OASDI) in 2026: the $184,500 wage base

The rule that matters

In 2026, Social Security tax applies to wages up to $184,500. That number is called the maximum taxable earnings or the wage base.

What it looks like on your pay stub

- Early in the year: the OASDI / SS line shows up each paycheck.

- Once your year-to-date Social Security wages reach $184,500: the Social Security line can drop to $0.

- In January of the next year: the Social Security line usually starts again because the cap resets each calendar year.

The quick math

- Employee Social Security rate: 6.2%

- Wage base: $184,500

- Max employee Social Security withholding for 2026: $11,439

So if you earn at least $184,500 in Social Security wages during 2026, your Social Security withholding will top out around $11,439 for that year.

A simple example

- If you earn $10,000 per paycheck and get paid twice a month, you may hit the wage base in the fall.

- After that point, your take-home pay often rises because Social Security stops, even though nothing else changed.

This surprises people every year because the paycheck looks “bigger” for no obvious reason. (Source:- ssa.gov)

3) Medicare in 2026: why it never stops

Medicare is different.

- Employee Medicare rate: 1.45%

- Medicare wage cap: none

That is why the MED / HI line keeps showing on your pay stub all year, even after Social Security stops.

A quick check

If you look at Medicare and it changes from paycheck to paycheck, it is usually because your Medicare wages changed (bonus, overtime, pre-tax items, or different hours). The Medicare rate itself is not changing every week. (Source:- irs.gov)

4) Additional Medicare Tax (0.9%): why a new line can appear

Some pay stubs show a third Medicare-related line, often called:

- Additional Medicare

- Addl MED

- Medicare Addl

This is an extra 0.9% withholding that starts after wages pass a threshold.

The part that confuses people

Employers start withholding Additional Medicare Tax once your wages for the year go over $200,000.

Your actual tax threshold can depend on filing status. That is why some people see the withholding even though they think they are “not a high earner,” or they do not owe it after filing.

The pay stub view is simple:

- Under $200,000 wages so far: no Additional Medicare line

- Over $200,000 wages so far: Additional Medicare line may start

(Source:- irs.gov)

5) Why your “taxable wages” might look lower than gross pay

A lot of pay stub confusion comes from one line: gross pay.

Gross pay is the top-line earnings number, but payroll taxes often use different wage totals:

- Social Security wages

- Medicare wages

- Federal taxable wages

- State taxable wages

These totals can differ when you have pre-tax items such as:

- retirement deferrals (like a 401(k))

- certain health benefits

- HSA or FSA contributions

So you might see:

- Gross wages: $2,000

- Social Security wages: $1,900

- Medicare wages: $1,900

Nothing is “wrong” just because the numbers do not match. It often means some part of your pay went to a pre-tax item.

6) The 7 most common “why did my pay stub change?” scenarios

Scenario A: “My Social Security line went to zero”

Most of the time, you hit the $184,500 wage base. Your Social Security withholding stops for the rest of 2026. Medicare keeps going.

Scenario B: “Social Security started again in January”

That is normal. The wage base resets each calendar year.

Scenario C: “I changed jobs and Social Security seems too high”

With two employers in the same year, each employer may withhold Social Security as if they are your only employer. That can create excess withholding across the year.

This shows up often when:

- you switch jobs mid-year

- you work two jobs at the same time

- you have a W-2 job plus another W-2 job later

Scenario D: “A bonus paycheck changed everything”

A large bonus can push year-to-date wages over the wage base faster. That can make Social Security stop earlier than you expected. It can also push wages over $200,000 and trigger Additional Medicare withholding.

Scenario E: “My overtime looks fine but the taxes jumped”

Higher wages mean higher withholding totals. The rates may be the same, but the wage base for that paycheck is bigger.

Scenario F: “My Medicare is larger than I expected”

Medicare has no wage cap, so it does not drop off later in the year the way Social Security can.

Scenario G: “My coworker has different lines than I do”

Pay stub lines vary by:

- benefit elections

- retirement elections

- filing status entries (W-4)

- wage level (cap reached or not)

- location and state rules

Two stubs can look very different even for the same employer.

7) Quick math checks you can do in 30 seconds

These are simple checks that catch most issues without turning into a tax project.

Check 1: Social Security line

- If your stub shows OASDI, SS, or FICA-SS, it should be close to 6.2% of your Social Security wages for that pay period.

- If your year-to-date Social Security wages are already near $184,500, the Social Security amount may be small or zero.

Check 2: Medicare line

- Medicare should be close to 1.45% of your Medicare wages.

Check 3: Additional Medicare line

- If you see it, it is usually 0.9% of the Medicare wages over the threshold, starting after your wages pass $200,000 in the year.

If the math is far off, look for a second wage base line (taxable wages) before assuming payroll made a mistake.

8) “I think too much Social Security was withheld” — what people usually do next

Start with the simplest step: ask payroll for a review. Many issues come down to a setup or timing detail that payroll can explain.

If you had two or more employers in the same year, excess Social Security withholding may be handled as a credit on your federal return.

If the excess came from one employer withholding incorrectly and the employer does not adjust it, the IRS has a separate refund path.

If your employer will not correct it, the IRS explains a refund request option using Form 843.

9) 2026 pay stub deduction glossary

Here is a plain glossary you can place right in the blog.

- FICA: the payroll taxes for Social Security and Medicare

- OASDI / SS: Social Security withholding

- Wage base: the yearly cap for Social Security taxable wages ($184,500 for 2026)

- MED / HI: Medicare withholding

- Additional Medicare: extra 0.9% Medicare withholding that can start after $200,000 wages in a year

- YTD: year-to-date totals; these help explain when Social Security will stop

10) FAQs

Why did Social Security tax stop on my paycheck in 2026?

You likely reached the 2026 Social Security wage base of $184,500. After that, Social Security withholding can stop for the rest of the year.

What is OASDI on a pay stub?

OASDI is the Social Security payroll tax line.

What is the 2026 Social Security wage base?

For 2026, the maximum taxable earnings base for Social Security is $184,500.

Does Medicare ever stop?

No. Medicare has no wage cap, so it can continue all year.

Why did Additional Medicare show up on my pay stub?

Employers start withholding the extra 0.9% once wages go over $200,000 in the calendar year.

Is the $200,000 Additional Medicare threshold the same for everyone?

Employer withholding starts at $200,000 wages. The final tax threshold depends on filing status.

I changed jobs. Can Social Security be withheld twice?

Yes. Each employer withholds based on wages they pay you. That can lead to excess Social Security withholding across the year.

If excess Social Security was withheld across employers, the IRS explains how it is handled on the return.

Why do my Social Security wages look different from gross pay?

Pre-tax items can lower the wage amount used for certain payroll taxes.

What is the difference between Social Security and Medicare on a pay stub?

Social Security has a wage base cap. Medicare does not.

Where do I see these totals at year end?

Your W-2 shows Social Security wages and Medicare wages, along with amounts withheld.

Need a pay stub for income verification?

If you are pulling documents for a loan, rental, or job verification, a clear pay stub helps show your gross pay, deduction lines (OASDI and Medicare), net pay, and YTD totals in one place. ePayStub lets you generate a printable pay stub using your pay rate, hours, pay frequency, and deduction details, so the numbers are easy to review and match what you expect in 2026.

Read more:-

- Oregon SB 906 (2026): New-Hire Pay Stub Explanation Notice (Payroll Codes)

- What Is Annual Income? Gross vs Net, What Counts, and How To Calculate It

- Pay Stub Requirements by State (2026) + Chart & Checklist

- ePaystubs generator for clear payroll records

- Looking for a Paystub Generator? Here is Why ePaystubs Makes the Process Simple

- How to Void Check Safely for Direct Deposit, Bills or Fixed Mistakes

- How to Tell a Real Pay Stub from a Fake One (2026 Verification Checklist)